Use Tax

MORE THAN 305 MISSOURI CITIES HAVE A USE TAX

A Use Tax Funds Community Services & Generates Local Revenue. It Is NOT A Double Tax!

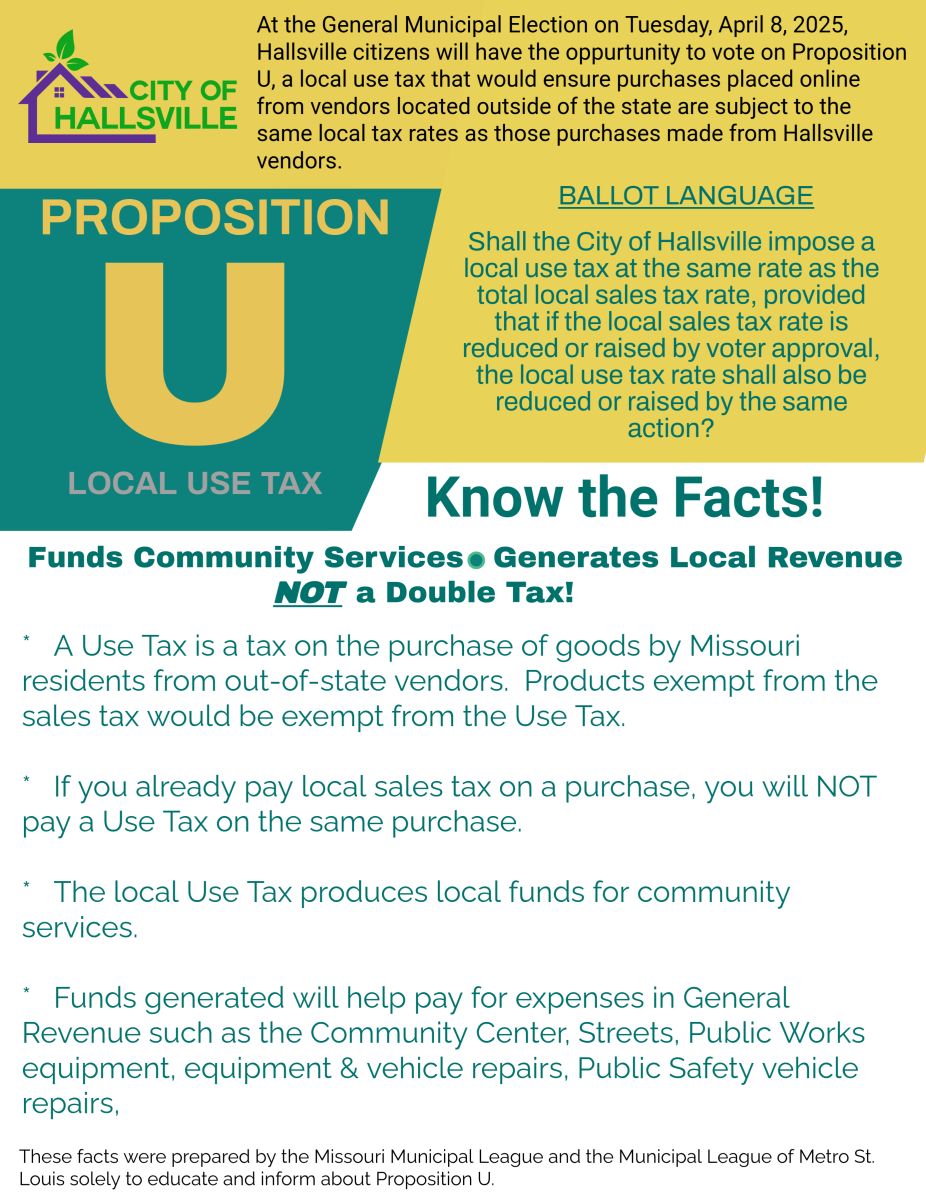

The Hallsville Board of Aldermen voted to call a special election on the question of whether to impose a local use tax. The election will take place Tuesday, April 8, 2025.

A use tax would ensure that purchases from online vendors located outside of the state are subject to the same local tax rates as those purchases made from Hallsville vendors.

It would also help the City maintain its revenue while continuing to provide the services our residents expect plus more.

Official ballot language

PROPOSITION U

Shall the City of Hallsville impose a local use tax at the same rate as the total local sales tax rate, provided that if the local sales tax rate is reduced or raised by voter approval, the local use tax rate shall also be reduced or raised by the same action?

☐ YES

☐ NO

If you are in favor of the question, place an “X” in the box opposite “YES”. If you are opposed to the question, place an “X” in the box opposite “NO”.

Frequently Asked Questions

I already pay sales tax, is this the same thing?

No. The sales tax applies to purchases made at retail within Missouri, while the use tax applies to purchases made from out-of-state vendors. Purchases cannot fall into both groups and therefore a purchase would not be taxed twice.

It Is NOT A Double Tax!

What is the use tax rate?

The use tax is imposed at the same rate as the total local sales tax rate, currently two percent (2.625%). If the local sales tax rate is reduced or raised by voter approval, the local use tax rate shall also be reduced or raised by the same action.

Why is this important to City of Hallsville’s residents?

With no local use tax in place, consumers have an incentive to purchase items from out-of-state vendors instead of buying locally. This costs the city local jobs and tax revenue because millions of dollars are sent out of our state and local economy.

The City of Hallsville needs to maintain this revenue stream for vital City services such as:

- The Morgenthaler House and Mercantile Building & Museum: utility maintenance, upkeep of the grounds, and covering a large portion of the utility cost

- Community Center

- Park

- Streets

- Public Works

- Vehicles & Equipment repairs

- Public Safety

- Sidewalks

Do other Missouri cities have a use tax?

Yes. Approximately half of all Missouri cities with populations of 2,000 or more already have a use tax in place. The City of Hallsville does not. Large cities with a use tax are Kansas City, St. Louis and Springfield. Cities in the mid-Missouri area with a use tax are Columbia, Boonville, Fayette, Fulton, Holts Summit, Mexico, Moberly and Sturgeon.

Will the use tax apply to online purchases?

It depends on where the transaction occurs. If goods are purchased from a vendor located in Missouri, sales tax is applied at the rate applicable to the vendor’s location. If goods are purchased from a vendor outside of Missouri the use tax applies.